If you’ve got access to the NEW Amal Invest experience, I’d love to get your feedback below ![]()

(If you don’t have access yet, please book an onboarding slot on my calendar)

If you’ve got access to the NEW Amal Invest experience, I’d love to get your feedback below ![]()

(If you don’t have access yet, please book an onboarding slot on my calendar)

Thank you Yazin for the opportunity to share our experience with you.

I hope the best for you & for the platform.

Here are some issues that I have encountered while using the new Amal Invest:

Tha Market Value in the Home Screen for the filtered funds is shown correctly, but when I go to each fund individually it is not updated with the latest purchases done to that fund, so the Market Value that is shown inside the fund is not correct.

See here for example, in the Home Screen, the filtered VOO is reflecting a market value of $435 (which is right, after I made a new investment), but when I click the fund to see further details, it shows that the market value is only $227 ! (which is not right, it’s the market value of the first investment & hasn’t been updated after the second investment)

This issue is present to all the funds that has more than one investment, it’s only reflecting the market value of the first investment.

When I click a fund to see its details, there is bug of (fixed) percentage to the market value change over the previous month, which is fixed to 20.1% to all my funds!

The issue is clearly demonstrated when you go to a newly created fund that has no positions yet, which should reflect 0% change, not a 20.1% !

it will be clear when you see these few examples:

As you can see here, the JEPQ has 20.1% change from last month, which is the same percentage shown in the VOO fund (which has different positions & values, therefore it’s unlikely to be the same percentage), and also the same percentage to the VIG fund with has no positions at all!

Then I have to click the X button or have to go to the Home Screen, from there I have to click on the newly created fund to start investing (multiple steps not needed)

The platform does not refresh automatically;

For example, when I delete a fund from inside its page, it takes me to the Home Screen, which now should reflect the new remaining funds without the recently deleted ones, instead it shows me all the funds including the deleted one & I have to refresh the platform manually.

Even when I click Home it does nothing I have to refresh the website manually.

Hope these are clear to you.

Again I had the pleasure testing it so early, thank you for this opportunity.

Regards,

Hussain.

Salam again;

Regarding portfolio analysis in the main screen, the chart is extending to beyond the columns which is very annoying when tracking it.

It would be much better to set the last date just before it reaches the the money column.

Also, I have a few suggestions in regards to the analysis of the portfolio:

The use:

if I added a new fund to the account, the current analysis would recognize it as positive increase to the value of the portfolio, instead, I want to track the performance of the invested money: their ups & downs.

Because there are multiple times that we will fund our accounts with cash that we would not invest right away, rather we might wait for days or even months to invest it

My point:

If I have invested an $10,000 in the filtered funds, I want to see the analysis/performance of the main screen for this $10,000. How much it gains or loose (by % and $), so the cost basis is the $10,000 and the portfolio is the net increase/decrease to this invested amount (and not to the total portfolio of the available cash+invested money)

Another suggestion:

Hope this is clear

Salam @Hussain, and thanks so much for the feedback.

I’ve addressed the points you raised below, and will update this post as I make progress on the fixes/improvements:

I had a look and this appears to be related to the “Refresh” issue that you highlighted so I’ll address it there.

My bad… I’d forgotten to remove the hard-coded reference! I’ve removed it for now, and will re-add the correct calculation shortly. Thanks!

![]() Pending: Restore the correct percentage-difference calculations

Pending: Restore the correct percentage-difference calculations

![]() Fixed

Fixed

![]() Fixed the specific issue you highlighted

Fixed the specific issue you highlighted

There’s a larger issue around keeping the different pages in the platform up-to-date when changes happen without requiring a full refresh. I’ve now pushed fixes for the List of Funds on the main page, and am patching the Fund Details page (specifically: the amounts and the Activity Log).

![]() Pending: Keep fund stats, Activity Log up-to-date on Fund Details page

Pending: Keep fund stats, Activity Log up-to-date on Fund Details page

![]() Fixed

Fixed

![]() Fixed

Fixed

This is actually how I implemented it initially. The reason I later removed it is because it makes it hard to tell what your actual performance is like.

Investing $100 in a new fund would cause the chart to go up, just as earning $100 in profit – and you won’t be able to tell the difference just by looking at the chart. (You might be able to guess, by seeing if the cost basis line goes up together with the chart – but I found it very confusing personally.)

Happy to consider suggestions about how to better visualize the performance of the overall account. (And if you have an example of what sort of chart you’re looking for, I’d love to see it too!).

Great idea, I think a pie chart would be a great way to show this. I’ve added this as a suggestion and will work on releasing this soon inshallah.

Thanks once more for all the great feedback, please keep it coming! ![]()

Thank you for addressing theses issues.

Yes, it will go up but not as earning profit, because the the cost basis is also will go up simultaneously, and the difference in market value will make the chart clear (either profit: above the cost basis line, or loss: then it will cross it and become below it)

Here is an example of the idea, as long as I’m investing new money, the cost basis will go up, and the market value as well, as a ladder over time.

and when moving the curser to a certain line intersection, it will show the exact info of invested money (=cost basis) and the market value at that specific date.

exactly.

See here an example of how it would be:

and besides the visual chart we can see the details in-written language.

I’v made an example of it in Excel, so I think it’s not difficult to implement

Waiting for all the fixes to be done, and happy to hear your thoughts on the chart ideas I’ve shared now.

Salam again ![]()

Regarding email notifications, I liked that they are minimalist with clean, user-friendly designs (thumbs up);

I have encountered some issues:

The other thing about this email, that I received too many emails of the exact same content (duplicate copies), which as annoying & as a result my mail provider considered them as Junk.

Another issue, is that when an original fund changes some of its positions, I receive an email of that notification of change, but the trades are zero, so actually no change has happened & no selling will take place

So I don’t know if this is an error or what, but if there is a change but no order will take place I would prefer not to receive such email (unless there is a selling order to be executed)

And I received separate emails for each fund change, not combined as in the Sharia-compliance email.

I’ll keep rolling issues as long as I encounter them, hope you don’t mind ![]()

Thanks for the response, and the (excellent) charts!

Got it. I can see that this would actually be quite useful. Thinking of adding an option to “Include cash” that’s checked by default. You can uncheck it to see the chart exactly as you described. What do you think, @Hussain?

![]() Feature: Add “Include Cash” option in the main portfolio chart

Feature: Add “Include Cash” option in the main portfolio chart

![]() Feature: Add Pie Chart showing breakdown of the different filtered funds invested in, by market value.

Feature: Add Pie Chart showing breakdown of the different filtered funds invested in, by market value.

Yes, it’s actually 24 hours from the moment you submitted the change (not market open). We do this because we want to give you enough of a heads up before committing any automated trades on your behalf. Let me know if you have suggestions for how you’d rather see this work? I’m thinking we could just include a setting that lets you bypass this safeguard. Would that be useful for you?

This is definitely a bug. It should only have sent a single email. Looking into this to see why…

![]() Pending: Troubleshoot duplicate “Selling non-compliant assets” email notifications

Pending: Troubleshoot duplicate “Selling non-compliant assets” email notifications

Another bug, you should not have received an email if no trades would take place.

![]() Pending: Troubleshoot “Liquidate dropped fund holdings” email getting sent with 0 assets

Pending: Troubleshoot “Liquidate dropped fund holdings” email getting sent with 0 assets

![]() Fixed (29 Aug, 2023)

Fixed (29 Aug, 2023)

That’s by design. We use separate emails for fund changes since they don’t always take place at the same time. Funds update at different times and on different intervals. Once I resolve the bug with 0-asset updates, it should reduce email volume for fund changes.

Not at all, please do! ![]()

Sounds great!

In regards to the same topic:

The auto-selling of non-sharia complaint stock has been executed successfully, but in the activity log of each fund is showing “unknown action” ![]()

So now I don’t know how much money was sold from each particular fund, so I can re-invest them again in the same fund (until the auto-reinvest feature comes out)

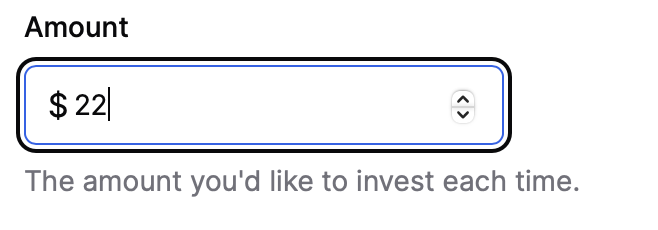

I just tried to test the Recurring Buy feature, but the Starting date is not clickable, so when I click on it the calendar does not prompt up, so I can’t create a recurring investment.

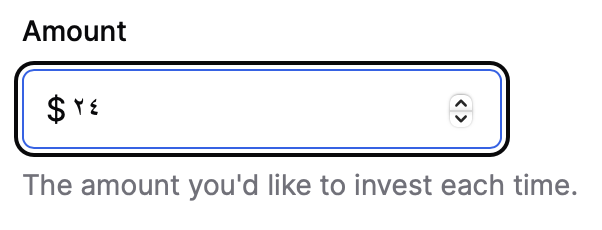

There is also a visual issue, my keyboard default numerics are the Arabic style, but the website showed them in the Indian style when I used the arrows to set an amount …

General question:

As I understood from you during the onboarding, when I invest in a fund, the amounts allocated to each position would be determined by the weights target but to a minimum amount of $1,

But the next investment should allocate money to the positions that hasn’t been allocated for in the previous order, because of the minimum $1 orders, to make them go for their targets weights. Am I right?

What actually happened is, that the second investment allocates the money again to positions that already been invested in, and there are still some positions that has zero dollars! which is weird for me, as I thought the balancing would occur with each new buy order.

Could you please give us some explanation on how this is working?

Thanks for your efforts.

Thanks for getting back to me with more feedback, @Hussain! ![]()

![]() Fixed, you should now be able to see the liquidation action along with all the details

Fixed, you should now be able to see the liquidation action along with all the details

![]() Fixed, should show numbers in English (Can you please confirm that’s the case, haven’t been able to test this myself)

Fixed, should show numbers in English (Can you please confirm that’s the case, haven’t been able to test this myself)

That’s very strange. Can you please let me know what device/browser you’re using so I can try this out? I’ve tested on mobile as well as my laptop and wasn’t able to reproduce this.

Of course, happy to! I must’ve misspoken when I said that it would always allocate funds to the other stocks. Allow me to explain this in detail.

When you invest additional funds into your portfolio, the system aims to distribute these funds across your chosen stocks in a way that aligns with your target allocation percentages. This process is called rebalancing.

Let’s say you have a portfolio with three stocks: Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN). You want your portfolio to be 50% AAPL, 30% MSFT, and 20% AMZN. These are your target weights.

If you have $1000 to invest, ideally, you would want to invest $500 in AAPL, $300 in MSFT, and $200 in AMZN.

However, let’s say your current portfolio is $400 AAPL, $400 MSFT, and $200 AMZN. This is not aligned with your target weights. So, you need to rebalance.

The system calculates the difference between the current value of each stock and its target value (based on the target weights). It then sorts these differences to identify which stocks are most underweight (i.e., they have a larger negative difference).

The system then sequentially allocates funds to each underweight stock, starting with the most underweight, until either all funds are allocated or the stock reaches its target weight. If there are still funds remaining after all underweight stocks have reached their target weights, the system continues to the next most underweight stock.

In our example, the system would first allocate funds to AAPL (since it’s the most underweight), then to MSFT, and finally to AMZN (if there are still funds remaining).

Now, let’s consider a scenario where you add a new stock to your portfolio, say Google (GOOG), but you don’t have any existing position in it. The system will consider GOOG as underweight since its current value is zero. However, whether the system will actually invest in this stock depends on several factors:

If there are enough funds to invest in all underweight stocks, then GOOG will definitely receive an investment. However, if the funds are limited, it’s possible that all funds are allocated to other, more underweight stocks, and GOOG receives no investment.

Also, there’s a minimum order size to consider. If the calculated investment for GOOG is below this minimum, the system will not place an order for this stock. Instead, it will allocate the funds to other stocks.

So, while adding a new stock to your portfolio increases the chances of it receiving an investment, it’s not guaranteed. The system always aims to bring your portfolio as close as possible to your target weights, given the available funds and the current values of the stocks.

Still the same, when typing by the keyboard there is no problem, but when using the arrows it defaults to the arabic numerals. However it’s not an actual issue, not a big deal at all.

Still reproducible across different devices.

I’m using Apple devices with up-to-date operating systems (Mac, iPhone), and I’ve tried it in different browsers (Safari, DuckCuckGo) and the calendar does not prompt up.

I did not understand it clearly, but I see you’r talking about the ‘portfolio’, is this rebalancing considering all the stocks in the portfolio or is it a specific process to each individual ‘filtered fund’? I’m confused.

However, it’s a bit clear but my question would be, then when the low-weight stocks in the fund will have a pie from the invested money?

this will takes time & lot of money to reach, since the balancing occurs to some the already purchased stocks (like AAPL, META, etc)

This would compromise the diversification that we wanted in the first place (at least for some times), putting the whole portfolio at risk of volatility.

I have an issue that’s only in the mobile browser but not when using a computer:

When I decide to invest more to a fund, the rectangle for the amount needed does not prompt me the keyboard to type, instead it only allows me to paste an already copied number

Now after the charts appeared in each filtered funds, they are far from the correct stats, as well the stats below them. needs to be reviewed.

Lastly, I think I have a major issue:

When the liquidation has been done due to non-complince (because of my new settings, not to include the ‘doubtful’ stocks), I decided to re-invest the money from the selling order again in each individual fund,

But, the new orders invested in the exact same stocks that have been recently liquidated! Which is very very strange to me.

I think the new setting (turning off the option to buy doubtful stocks) was applied to the selling, but still not active when I buy new stocks in the funds.

and now I cannot liquidate them manually because I don’t know exactly which stocks are non-compliant across all my different funds, even If I know I could not sell individual stocks through Amal.

See here are the images of both the liquidation order & re-investment order:

Side question, is there any plans to release an iOS & Android apps? or is this only a web-based platform?

Yes, there would be multiple stocks that are below the target weight (both existing stocks that have underperformed, and stocks that don’t have any positions). We allocate funds to the stocks that are most underweight, in absolute $-value (not in % terms).

For example, consider a portfolio that has:

TSLA: Target 10%, Current 8% (Needs $50 to get to 10%)

ASML: Target 1%, Current 0% (Needs $25 to get to 1%)

If you decide to invest $50, the entire amount will be allocated to the most underweight stock, which in this case is TSLA. If there’s any additional money after that (e.g. if we’re investing $60), then the excess will go to the next-most underweight stock (so $60 - 50 = $10 goes to ASML, in this example).

Please let me know if that’s still unclear. I’m planning to add some text to explain this in the order preview screen, so this discussion is very helpful!

@Hussain can you please confirm if this issue persists? I’m unable to reproduce this one either.

![]() Pending: Working on a fix for the the incorrect last portfolio data point.

Pending: Working on a fix for the the incorrect last portfolio data point.

As for the other errors you point to, it bears some explanation. It’s not obvious from the figure, but the stats below the chart are ~real-time while the chart shows data from the previous close. That’s why you might notice a difference between the Portfolio Value on the chart, and the Market Value beneath it.

Definitely a bug, looking into this now…

Update: ![]() Now fixed. All your funds should now reflect the latest settings you’ve set. Future changes to your settings will

Now fixed. All your funds should now reflect the latest settings you’ve set. Future changes to your settings will

Sharing some additional context here to explain what went wrong, @Hussain.

When you update your portfolio settings, especially those that might make certain stocks non-compliant with your new settings, you may expect these changes to take immediate effect on your portfolio’s funds. However, I designed the system with the assumption that new funds won’t get allocated to these non-compliant stocks, and thus we didn’t trigger any immediate changes to the existing funds. The funds get updated daily anyway, so I assumed the changes will get applied and the non-compliant stocks removed automatically.

However, that’s clearly a wrong assumption. The expectation should be that users would be able to make investments immediately after a settings change and have their portfolios reflect that change.

I’ve now updated the backend to automatically re-weight all your portfolios whenever you make a change. This will ensure that they take effect instantly – even if you decide to invest immediately after making the change.

Yes, working on that. You can see progress on the Official Roadmap 🆕 page

Thanks once more for the feedback and patience. Please let me know if you have any more questions!

Good ![]() , but now I still didn’t receive an email that some stocks need to be liquidated since they’re not compliant according to my settings (since the system invested in them again, they should be liquidated again. Right?)

, but now I still didn’t receive an email that some stocks need to be liquidated since they’re not compliant according to my settings (since the system invested in them again, they should be liquidated again. Right?)

Clear, thank you for the explanation, the text in order preview screen would be definitely helpful

But I still see this is risky to the diversification ![]() , however with time it will be resolved by its own

, however with time it will be resolved by its own

What about the other issues that I’ve mentioned?

Still present, I didn’t notice that you added them to the roadmap list ![]()

Thank you again and again for your patience with us

Given the $1 min order size constraint, you’re forced to decide on which part of the fund you want to mimic.

Our approach is to bring the biggest pieces in line first, rather than the smaller ones. Ultimately, however, both approaches do the same thing. Adding $1 more to a large position that’s underweight is the same as adding $1 to a slice without a position to bring it to the target weight. Both approaches bring you closer to the overall fund target.

The only reason I favor adding in the order of the most underweight positions by value is because it’s easier to track and manage a relatively smaller number of positions over a larger one.

Currently using the Roadmap only for tracking feature requests. I track bugs within these posts, and update the status from Pending → Fixed as they are addressed.

If there are any I’ve missed, please let me know

@Hussain @Omer @MohamedAbdelKhalik I’m considering making the “Allow Doubtful” setting a fund setting, and not a global setting. That way, you can decide - for each fund - whether you’re OK with doubtful stocks or not.

The reason for this is that it’s closely tied to the “If a stock turns non-compliant” setting, which is a fund-level setting:

What do you think?

Example to illustrate the problem:

Today, say someone decides they don’t want to invest in doubtful stocks anymore.

They can turn off the Doubtful setting, but unless the “If a stock turns non-compliant” setting in each portfolio is set to “Sell”, it won’t do anything.

I think this would be super-confusing, and very unintuitive. By having them all as fund-level settings, you have more control over what you want to do for each fund you’re invested in.

Yes still persisting, I’ll send you a screen recording with possible explanation to it.

__

Now I got it crystal clear ![]() , thank you!

, thank you!

__

With the example you illustrated, it’s definitely a better idea to make it a fund-level setting. Totally agree.

Agreed, that makes perfect sense.

Yes, that would be a good idea and would give the user more control!

Hi Yazin, I was wondering about two features:

I see both of these are upcoming in the product roadmap but do we have an ETA on them?

Thanks as always for your hard work on this!

Thanks @MohamedAbdelKhalik !

Planned for Monday

A bit later out, after finishing the ones above and a couple more. Feel free to references fundpurifier.com in the interim till this is ported over ![]()